Our Mission

To empower clients to live with financial peace of mind

Your Family CFO

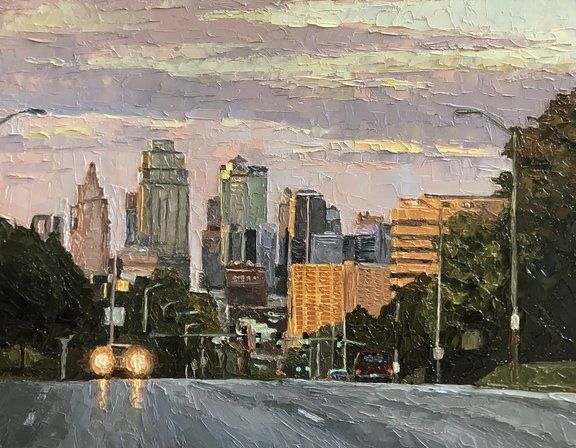

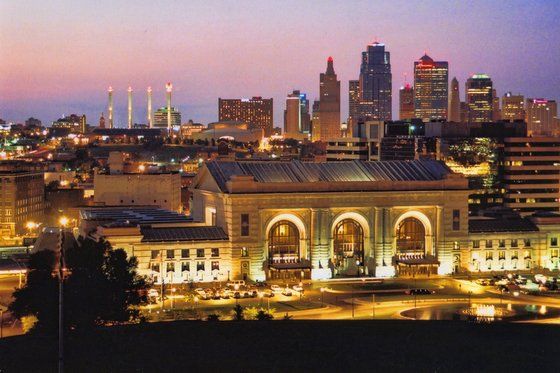

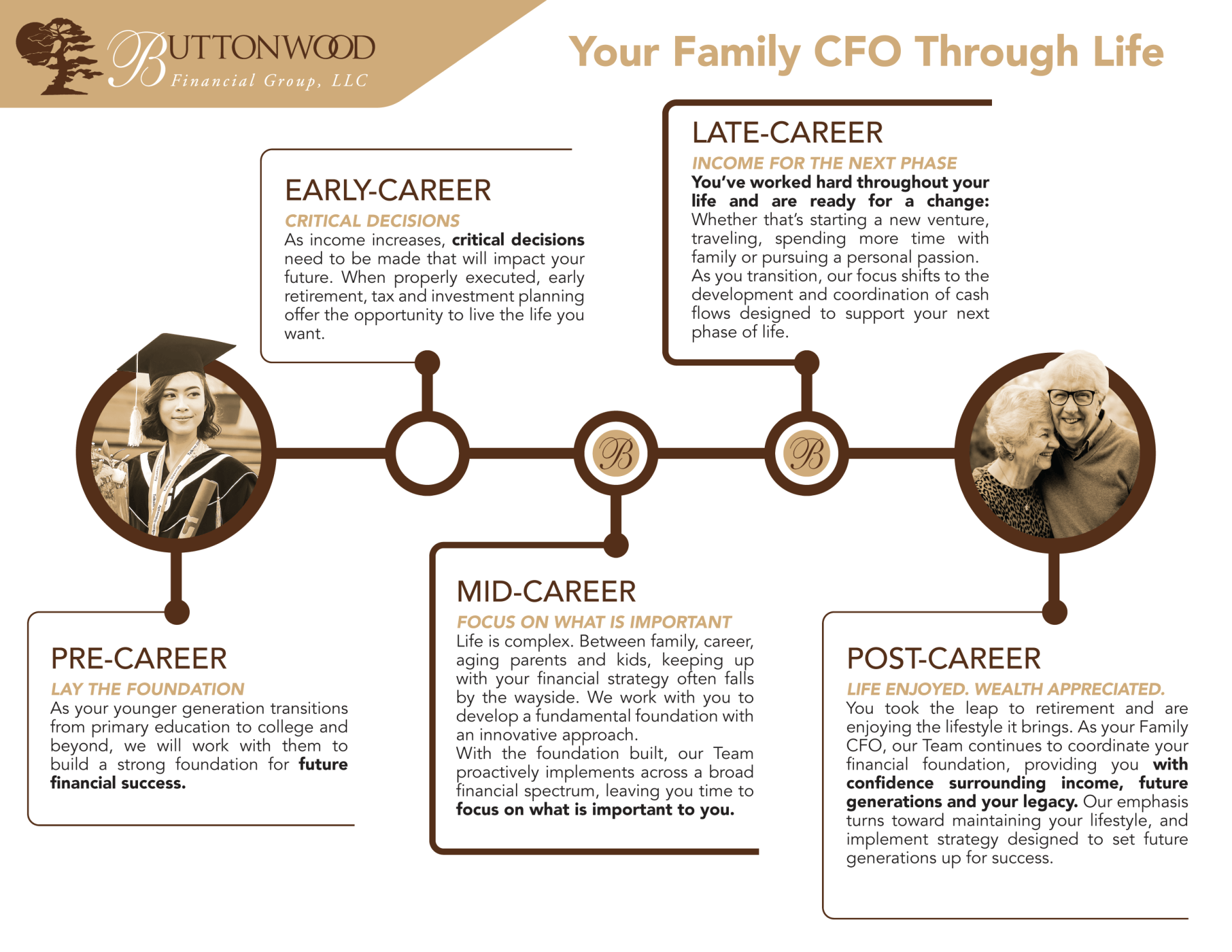

Buttonwood Financial Group is a comprehensive wealth management firm based in Kansas City, Missouri, assisting individuals and families with simplifying the complexity which comes with wealth. Serving as Family CFO, we’ll coordinate and integrate your financial life – including taxes, insurance, estate planning, investments, cash flow, retirement, education, and business strategies.

With our office also operating as a community art gallery, Buttonwood fulfills a philanthropic passion to give back to the community. We are uniquely dedicated to supporting the arts, education and other charitable causes.

What We Do

At Buttonwood, we believe in the fact that as wealth builds, life doesn’t get simpler – it gets more complex. Our goal is to simplify the financial process for families who would like to protect and grow their money.

You are the CEO of your family. Who is your Family CFO? This is the role Buttonwood fulfills for our clients every day! As Your Family CFO, we provide comprehensive tax, insurance, estate, investment, cash flow, retirement, education and business strategies – all integrated into your life and based around your specific goals.

Who We Work With

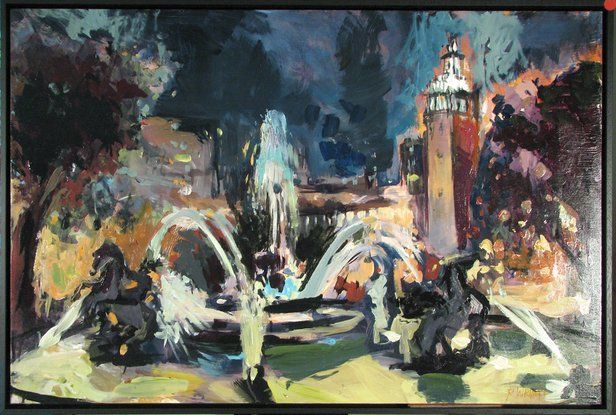

Proudly Supporting Our Community & Celebrating Local Artists

Buttonwood Art Space is a community focused art space and gallery located within the Buttonwood building in Mid-town Kansas City, MO. Our gallery is a place for local and regional artists to share their artworks and their commitment to non-profit charities.

Ready to Talk?

Are you ready to explore the benefits of your very own CFO? Schedule a Conversation Today!