Our Approach

Why Buttonwood Financial Group?

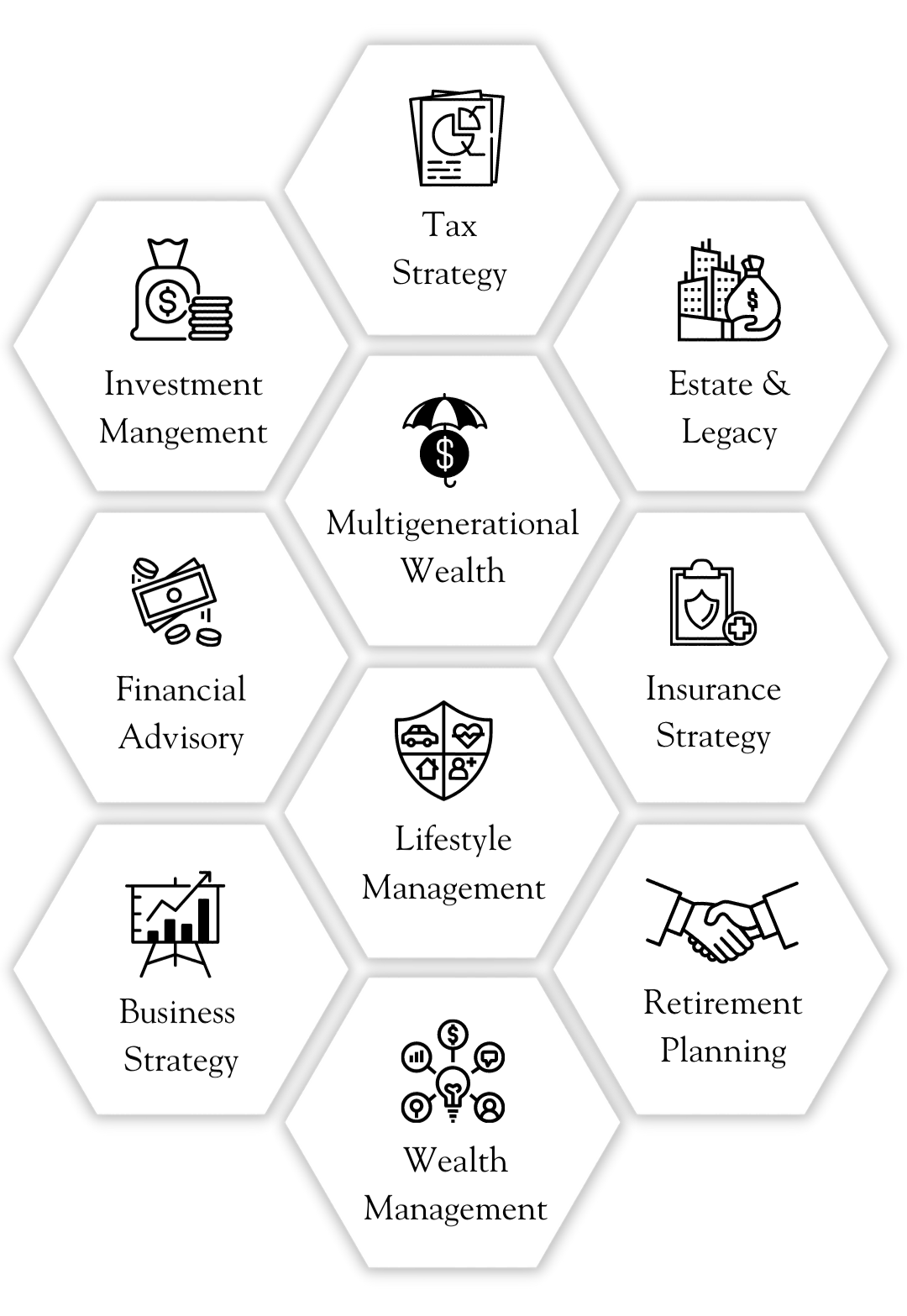

You are the CEO of your Family! As your Family CFO, our attention is on your unique needs and situation. We work with those seeking a long-term relationship focused on developing, implementing, monitoring and simplifying the core aspects of your financial life: Assets & Liabilities, Income & Expenses, Tax, Insurance and Estate.

When it comes to your financial life, generally investment products don’t provide the solution; coordinated strategy does. Our Team develops and implements real strategy designed to protect and grow wealth, leaving our clients time to focus on family, career and life.

When investment, business, tax and estate strategy is coordinated through a multigenerational lens, the outcome is impactful and can benefit every generation. Our multigenerational approach works for your entire family; up, down and across generations.

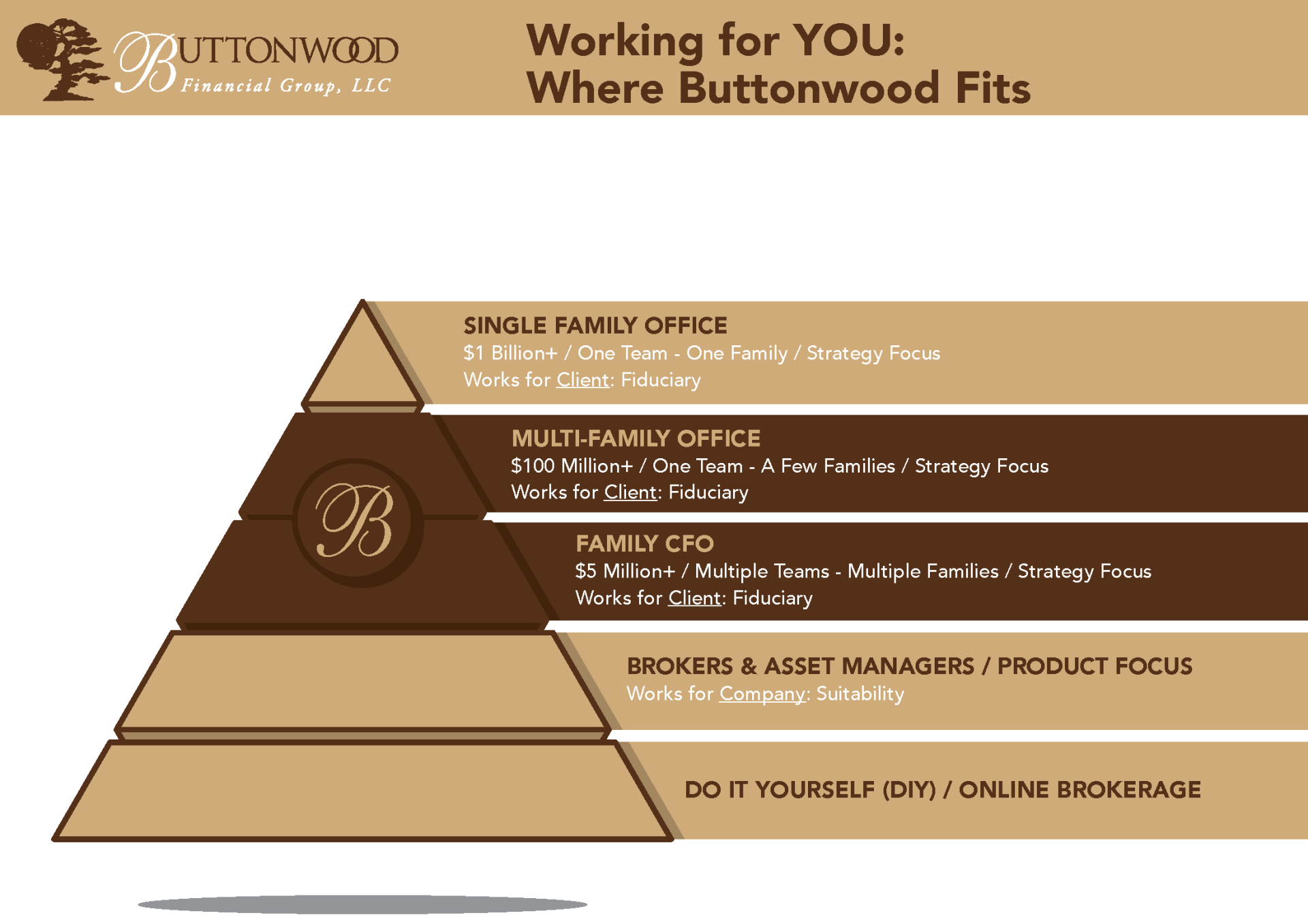

Individuals and families will find many options when looking for a financial relationship. Buttonwood Financial Group serves a unique set of clientele: Those looking for a fiduciary Family CFO Team who works for them, not for a big company.

Generally, investment managers focus on what they manage – investments. Tax centric firms focus first on tax. Insurance firms tend to turn to insurance products to address challenges, and legal firms dive deep into estate and law. While often very talented, many of these providers are not synchronized with unique multigenerational family strategy, much less each other.

While essential, we often see holes in strategy and opportunities left on the table from these narrower perspectives. Our inclusive role as Family CFO allows us to coordinate investments as we work with other professional talent to develop, coordinate and implement comprehensive

multigenerational strategy.

Our Unique Approach to Simplified Wealth

You are the CEO of your Family! As your Family CFO, our attention is on your unique needs and situation. Our multigenerational approach works for your entire family; up, down and across generations.

INITIAL STRATEGY

We've met and discussed the details unique to your life. Now, it is time to define and prioritize your initial strategy.

IMPLEMENTATION

Our Team will complete the necessary paperwork, coordinate signatures with you and connect your accounts to our technology platforms. At this phase, expect communication from both our Advisory & Operations Teams as we begin to execute the strategy.

ORGANIZATION

With accounts connected through our industry leading technology, you now have access to your financial life. It provides a true sense of accomplishment to know where all your financial assets are and how they are working together.

SIMPLIFICATION

With your financial foundation in place, your family CFO Team is simplifying your life. We are streaming cash flows, managing investments and coordinating strategies for tax, insurance and your estate plan.

DIRECTION

Through ongoing proactive engagement, together, we will monitor and revise strategy as you and your family move through life's transitions. Our services provide peace of mind: Your financial life is moving in the right direction; even when life throws the occasional curveball.

Ready to Talk?

Are you ready to explore the benefits of your very own CFO? Schedule a Conversation Today!