Buttonwood Investment Policy Committee Update – June 2019

Tariffs, essentially a tax, should slow the economy and increase inflation. However, the consumer, representing about 70% of the GDP of the US, remains optimistic and continues to spend on the back of strong labor markets and salary increases. Which camp is right? Is the next recession around the corner or can the economic growth continue?

Often the markets turn to the Federal Reserve for their interpretation, via interest rate policy. Unfortunately, there is no black and white answer on the economy until we have the advantage of hindsight. However, this mixed economic picture has kept the Federal Reserve in a holding pattern since late December when they signaled they would likely stop interest rate hikes. Stop they have, and the markets reacted positively until recently, when tariffs expanded from China to Europe and then Mexico.

It was likely the expanded tariff talk that sent the stock markets declining between 7-10% in the month of May. Trade tensions and growth concerns continued without the Fed making any real comments. On Tuesday June 4, Fed Chair Jerome Powell sounded a dovish tone in a speech, noting that the Fed is monitoring the escalation in trade tensions and will act “as appropriate” to sustain the economic expansion. These comments were interpreted to imply the central bank was watching the escalating trade wars and were ready to act (reduce interest rates) to support the economy. The market is now pricing in close to a 90% chance of two rate cuts by the end of the year.

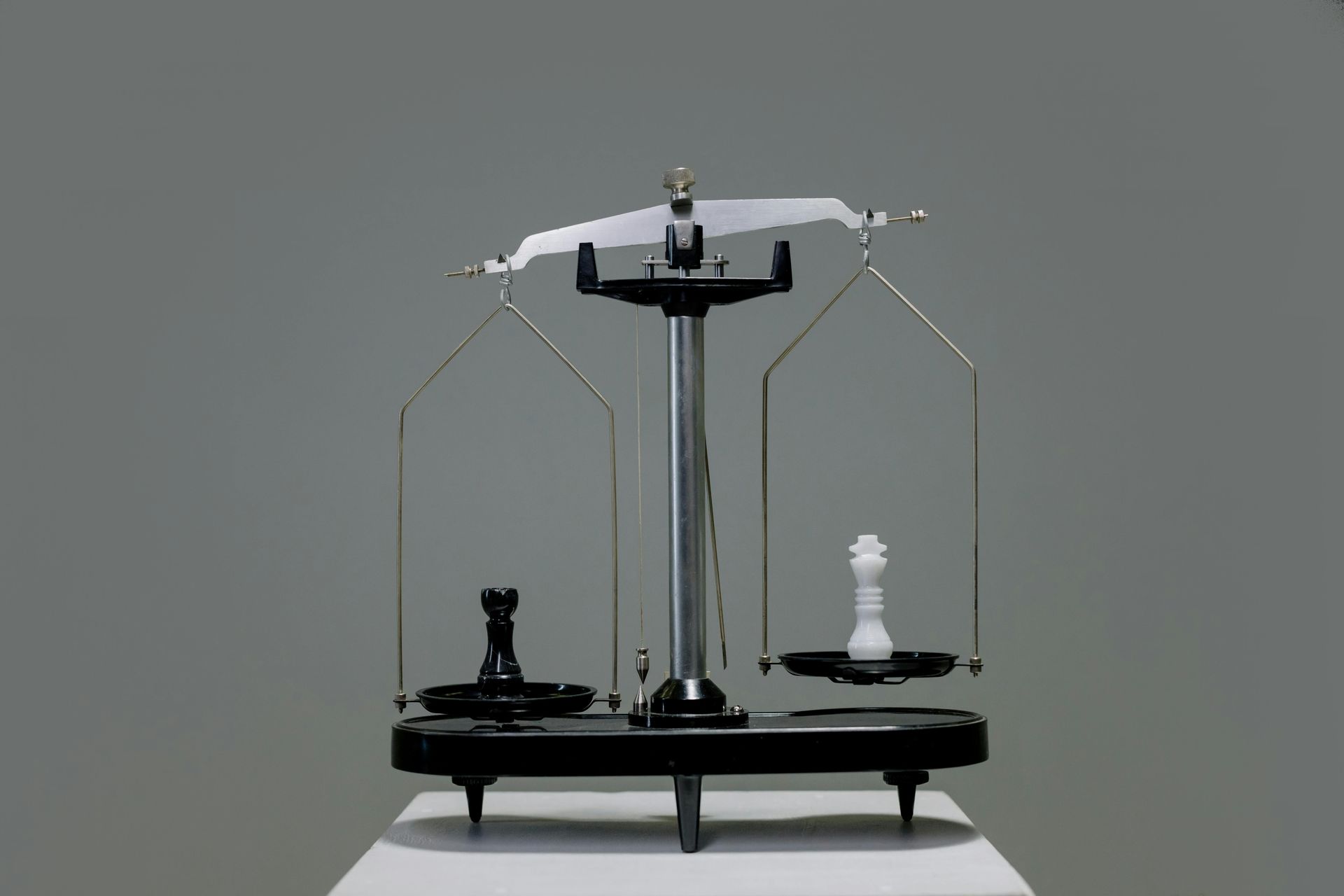

In reality, the Fed didn’t say they would cut rates, and if they actually do, it will likely send the signal the Fed is seeing weakness in the economy. At some point, either the stock market or the Fed will be forced to adjust their position. It is our thought; that when this point of adjustment occurs, we will have one of the more important signs to watch in place. As far as timing goes, we also believe, the election in November 2020 will be a focal point.

Buttonwood Investment Policy Committee

We still believe the US and major global economies will continue to grow in the months to come, however growth is slowing. Because of this we continue to elect to take a more conservative route as it aligns with our long-term investment objective of achieving a more consistent rate of return over full economic cycles. For those in withdraw phase we continue to hold / increase cash while receiving 2%+ yields. For assets targeting longer term growth we haven’t seen a technical reason to sell, and until we do we will stay the course in our already risk-reduced allocation. That said, we have shifted from reinvesting dividends and interest, to allowing these assets to accumulate in an interest bearing ‘sweep’ account.

If you would like to learn more about Buttonwood Financial Group’s Family CFO services and investment strategy, contact us today ! Click HERE to schedule an informal conversation with our team.

The post Buttonwood Investment Policy Committee Update – June 2019 appeared first on Buttonwood Financial Group, LLC.

Recent Buttonwood Articles

Are you ready to explore the benefits of your very own Family CFO?

Buttonwood Services

About Buttonwood Financial Group

Disclosures

Location

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Appointment Only

All Rights Reserved | Buttonwood Financial Group