Investment Policy Committee Update - February 2024

Our call to “buy the dip” in mid-October, amid the heat of a tumultuous three-month pullback, has aged well. But after the Fed’s surprise dovish pivot and corresponding, Bullcember to Remember, almost-everything-rally, some consolidation is likely warranted as investors reassess valuations and the state of the economy.

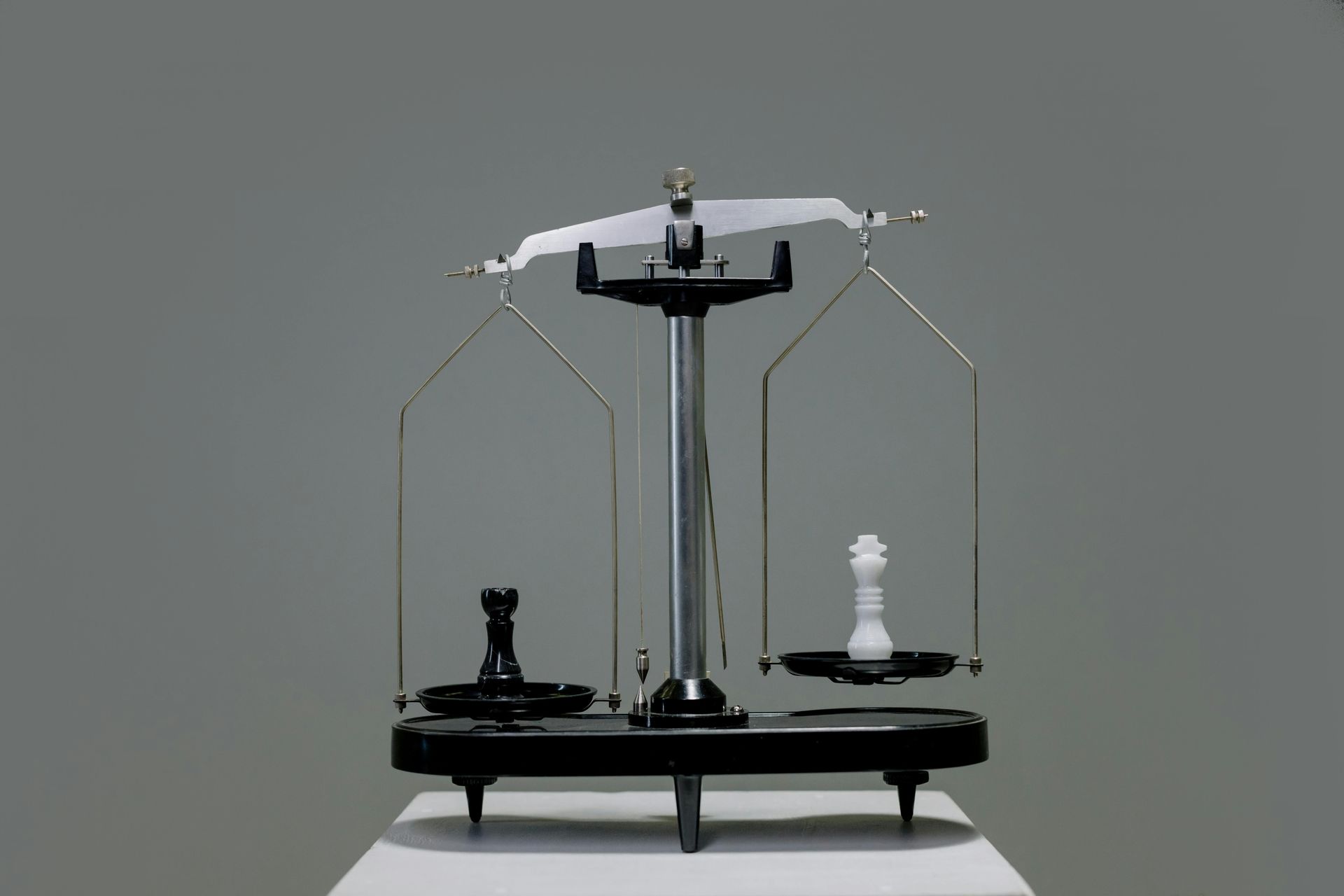

This could lead to some market volatility, and to combat that, we’re reducing our active tilts and repositioning to take advantage of possible greater dispersion and potentially more frequent rotations in market leadership. Fundamentally, we remain confident in the strength of the U.S. consumer and the durability of softening inflation. This should provide the Fed with the backdrop to make a soft-landing in 2024. Rate cuts and an early unwind of Quantitative Tightening, along with potential election-year stimulus, could further spur the economy. While we may have reservations in the short-term, we still want to remain leaning toward the side of a risk-on stance.

Given the underappreciated but persistent strength of the U.S. economy, we believe it is possible we could see investor enthusiasm for domestic value factor stocks reemerge. Recent improvements in these companies’ profitability and margins have them showing the best fundamental momentum now. In general, our belief is looser liquidity and higher earnings lead to higher prices for value stocks.

With our February rebalance, we’re also incorporating an actively managed factor rotation strategy to harness the daily trading, transparency, and tax efficiency of the ETF structure, in conjunction with the benefits of single security selection. Following a year of high concentration and narrow stock return breadth, we believe factor makeup and timing within equities may be a key ingredient to driving outperformance in 2024.

However, we don't believe the economy is immune to challenges. Any reversal in inflation trends or deepening of geopolitical conflicts remain risks to our cautiously bullish thesis. The labor market remains tight, but some softening has become visible, with continuing jobless claims reaching two-year highs. This may incentivize the Fed to follow-through with rate cuts but could also arguably be an early indicator of further weakness ahead. We continue to position the bond side of the portfolio as a ballast for protecting against this sort of potential volatility, with the treasury barbell in place and a freshly embedded active fixed income strategy aimed at generating attractive yields and capable of swiftly adjusting to changing market conditions.

We will continue to provide ongoing updates on our views and investment positioning through posts like this and as we meet. If you have questions about investment strategy, please let us know and we will make sure to review details at our next meeting. And while we don’t recommend fixating on short-term market fluctuations, if you would like to check specific investment performance across all your accounts, the Orion Portal is available 24/7. Thank you for your continued trust and allowing us to coordinate your asset management as part of our Family CFO services!

Recent Buttonwood Articles

Are you ready to explore the benefits of your very own Family CFO?

Buttonwood Services

About Buttonwood Financial Group

Disclosures

Location

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Appointment Only

All Rights Reserved | Buttonwood Financial Group