Strategic Financial Moves in 2024 for Individuals and Families

In light of evolving market conditions, economic trends, and potential policy changes, it's essential for successful individuals and families to assess their financial strategies for 2024. At Buttonwood Financial Group, we understand both the unique challenges and opportunities that come with managing wealth. Below, we'll explore key considerations and provide strategic insights to help you navigate the upcoming financial landscape.

1. Economic Outlook:

In the context of the ever-evolving economic landscape, it is imperative to gain a nuanced understanding of where we are in the prevailing economic cycle. Our comprehensive analysis considers current economic trends, potential implications (risk) for investment portfolios, and recommendations for strategic asset allocation adjustments based on economic forecasts. This section serves as a foundation for informed decision-making in the year ahead.

2. Tax Planning Strategies:

Given the potential impact of tax law on investment portfolios and balance sheets, a detailed exploration of both recent tax law changes as well as future tax impacts is essential. Our Advisors provide an in-depth overview of tax-efficient investment strategies, offering guidance on maximizing deductions and credits. This strategy aims to empower high-net-worth individuals to optimize their tax outcomes through proactive and strategic financial planning.

3. Investment Opportunities in 2024:

Uncover the potential for growth in economies entering the early stages of the economic cycle while avoiding high risk sectors in economies in later stages. At Buttonwood, the goal of our Investment Policy Committee is to produce a more consistent return – leading to a smoother financial ride on the roller coaster of life. We regularly engage with industry experts to make certain we have the full perspective needed for our diversified investment strategies. Our asset management is designed to take advantage of opportunities in the evolving investment landscape.

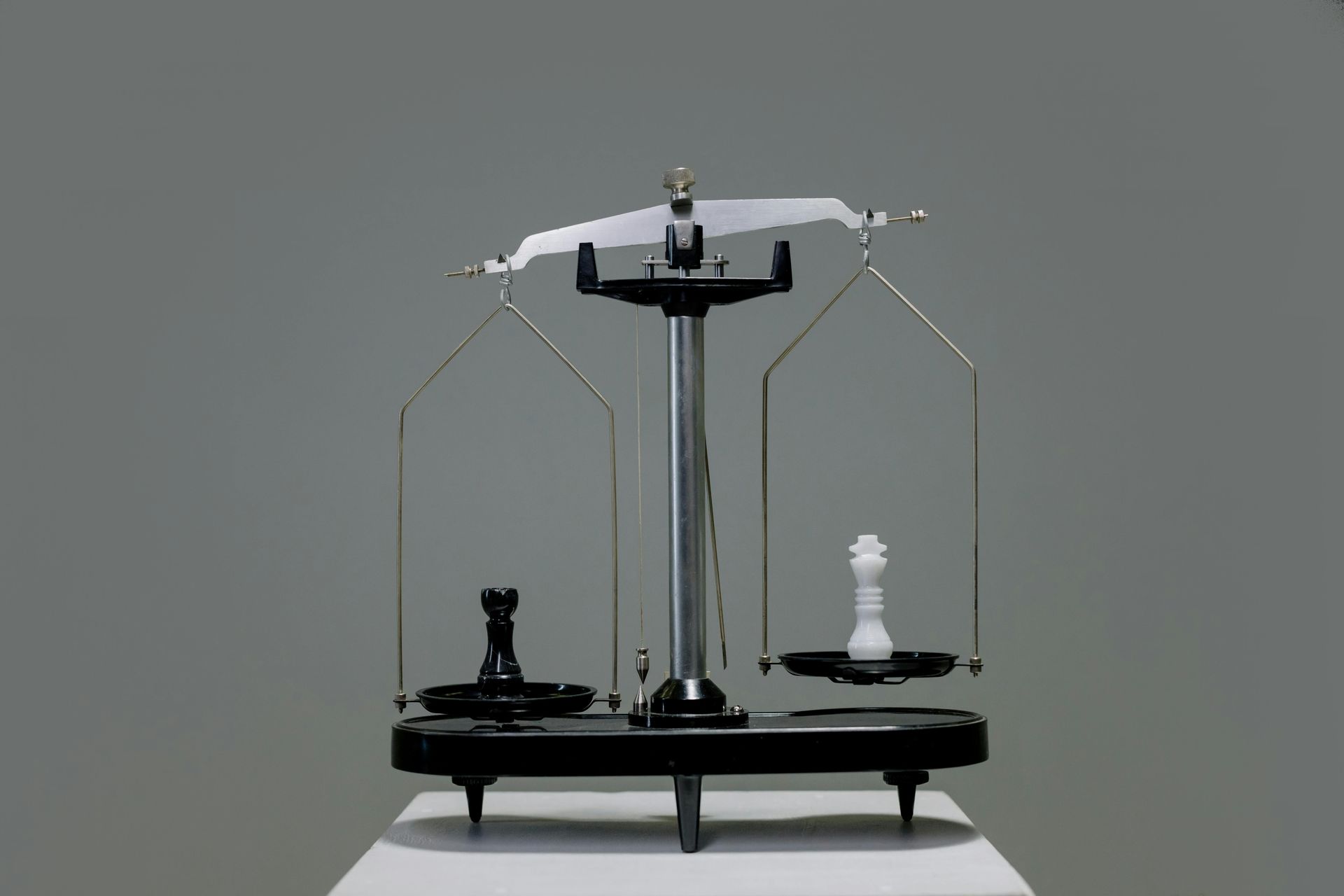

4. Risk Management and Asset Protection:

In the realm of wealth management, understanding and mitigating risks is paramount. Our detailed evaluation of risk and strategies for effective risk management is complemented by insights into asset protection, including considerations for insurance. The importance of periodic reviews around life, disability, home and auto, umbrella, long term care policies are key. In addition, with the possibility of the expiration of the increased Lifetime Exemption at the end of 2025, a review of estate planning documents needs to be emphasized in 2024 to ensure comprehensive protection and preservation of wealth.

5. Retirement Planning:

Tailored to meet each of our clients' unique needs, we offer strategies for managing retirement income. With insights into potential changes in retirement age and Social Security benefits, we provide actionable tips for optimizing retirement accounts and withdrawal strategies. Our goal is to empower individuals to make informed decisions that align with their long-term financial objectives.

6. Philanthropy and Legacy Planning:

For those with a philanthropic inclination, we provide options for meaningful charitable giving. Legacy planning considerations are discussed in detail, emphasizing the alignment of wealth with personal values. Strategies and accounts such as Donor-Advised funds, Private Family Foundations, and other Trust structures are reviewed to facilitate efficient and impactful philanthropy.

7. Market Volatility and the Importance of a Long-Term Perspective:

With elections around the globe and geopolitical uncertainty, 2024 is likely to be a volatile year. Having a trusted Team and real strategy allows you to maintain a disciplined, long-term approach to wealth management. Real-world case studies and examples illustrate the enduring value of a strategic, long-term perspective.

As your dedicated partner for comprehensive wealth management, Buttonwood Financial Group is committed to helping you achieve your financial objectives in 2024 and beyond. By staying informed, adapting to change, and proactively implementing strategic financial moves, together we position your financial life for continued success. If you have specific questions or would like personalized recommendations, our Team is here to assist you on your wealth management journey. Schedule a conversation today.

Recent Buttonwood Articles

Are you ready to explore the benefits of your very own Family CFO?