Upsizing vs Downsizing in Retirement

When the kids leave the nest and the family home seems too big and requires too much work to maintain, many retirees opt for new living arrangements. For many, the dream is to relocate to a warmer climate and a smaller home. Others may decide to stay put and rent out a portion of a large house to help with finances. Many others choose to remain in their current living conditions throughout their golden years.

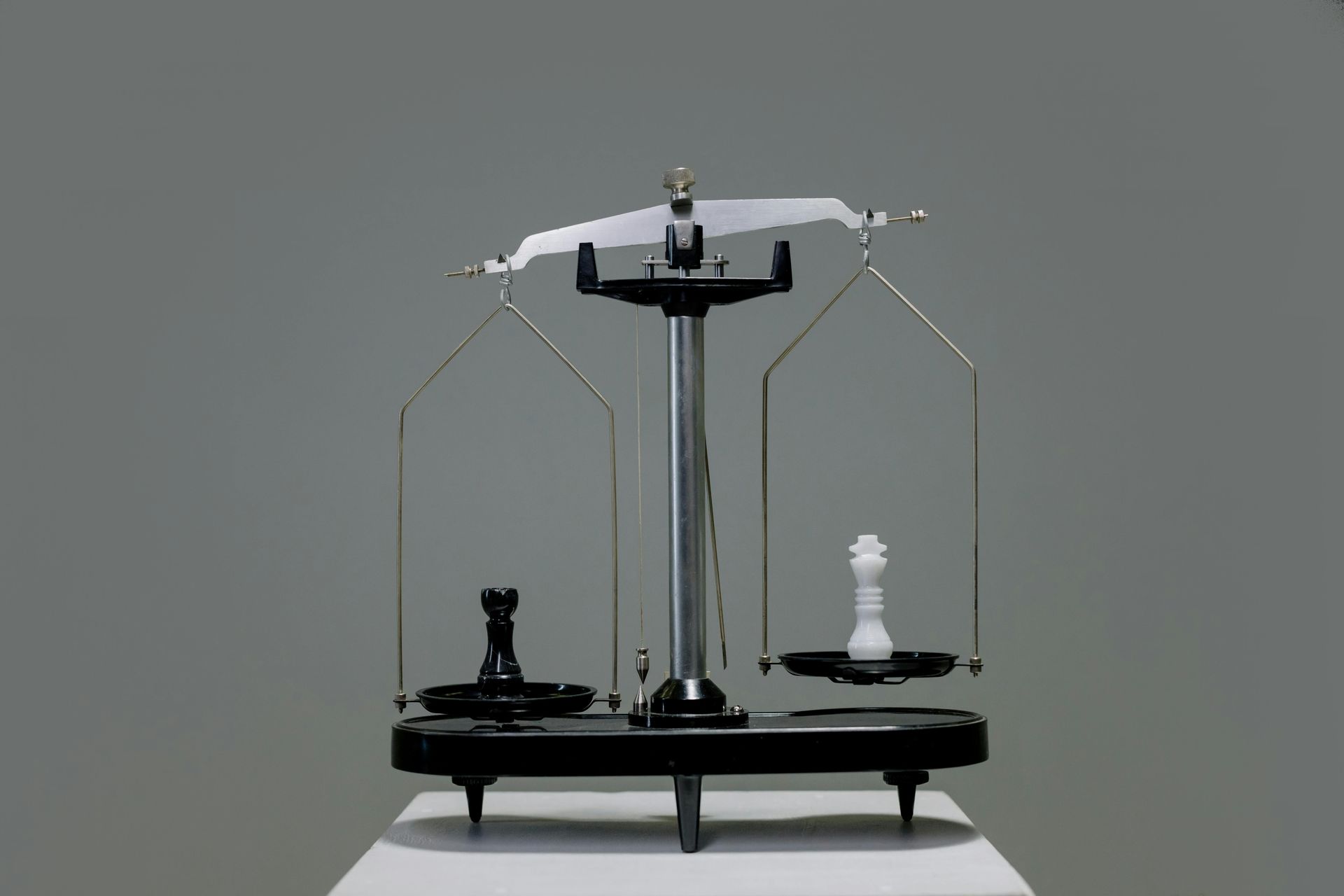

No matter what living situation you choose, the key is to plan early and plan strategically. Weigh all your options, consider the financial costs, and research new locations carefully.

Let's look at the pros and cons of downsizing and upsizing in retirement to help you make the best choice.

The Benefits of Downsizing

According to TD Ameritrade, 42% of Americans plan to downsize in retirement. Whether that choice is because they want to move to a warmer climate, want to be closer to family, or want to limit their housing expenses, downsizing has many benefits.1

Here are just a few:

Financial Freedom

Having financial freedom is a top concern for most seniors. Selling big and buying small may free up capital to purchase a new home or condo and invest the proceeds for extra income or pay off outstanding debt.

Less Maintenance

Maintaining and cleaning a smaller home is much easier and requires less upkeep. Townhomes and condos in retirement communities often include yard care and other services for seniors. Most communities have homeowners' association fees, so it's important to understand the yearly or monthly costs and what they cover.

Lower Monthly Costs

Monthly fixed expenses, such as utility bills, property taxes, and upkeep, are less expensive for most small homes. In addition, scaling back to one car will save you money on insurance and auto maintenance.

A Simpler Life

Living simply means that you now have time to enjoy the things you love. Maybe it's picking up an old hobby, attending special interest classes, traveling, or just good old-fashioned relaxing. Having fewer housing costs and maintenance means more time to spend on other things.

The Considerations of Downsizing

Of course, downsizing does have some drawbacks. Here are some to consider:

The Stress of Selling Your Home

Selling your home and moving is stressful. There are no two ways about it! Decluttering, repairs, and staging to get a home ready to sell can be time consuming and costly. It also takes organization and the will to part with what you no longer need or that won't fit into a smaller home. Parting with lifelong treasures can be an emotional ride.

Less Privacy

Less privacy is often the tradeoff of moving into smaller living quarters. There is less room to spread out in the house, and close neighbors are usually one patio or porch away in retirement communities, townhomes, and 55+ neighborhoods.

Less Space and Storage

Space is at a premium in small homes. Cramped quarters and less space are things to consider if you love to entertain and have family and friends over. Storage unit facilities are located near many retirement areas and are an option for those needing extra storage space that a smaller place just doesn't have (but that's one more expense to add to your retirement budget).

Expensive

It's expensive to move. Consider moving costs, real estate transaction fees, and tax liabilities when planning to downsize.

The Benefits of Upsizing in Retirement

One thing that's not often talked about in retirement is seniors choosing to upsize in their retirement, rather than downsize. There are many benefits to buying a bigger and newer home.2

Less Stress

Newer homes typically need less maintenance and renovations, which may become more difficult with aging. Buying a newer home can take the stress out of worrying about making much needed upgrades to your home.

More Space

Upsizing makes sense if family and friends visit often, or if extended family shares the home.

Option to Earn Extra Income

Earning income from a larger home often makes financial sense for retirees. Upsizing offers an opportunity to rent out additional living space in unused rooms, basement apartments, or a backyard accessory dwelling unit.

Considerations of Upsizing

Of course, while there are some benefits to upsizing, there are also some considerations. The main consideration is how much it will cost to keep your large home. Retirement income planning is the key to living a comfortable retirement, so it's important to run the numbers or work with a financial advisor to determine whether staying in your home is the right decision for you.

No matter whether you choose to downsize or upsize, the strategies for transitioning are the same. Research all financial aspects of a move, consider tax obligations, visit areas, or even rent for a while where you might relocate, and lastly, have all your financial ducks in a row, so no unforeseen problems arise. If you aren't sure which move to make, contact us today for a review of your retirement plan.

- https://www.annuity.org/retirement/lifestyle/downsize-for-retirement/#

- https://blog.massmutual.com/post/upsize-retirement

This content is developed from sources believed to be providing accurate information. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

Recent Buttonwood Articles

Are you ready to explore the benefits of your very own Family CFO?